In 2024, the dynamics of streaming pay per stream rates continue to shape the music industry landscape, influencing artists, record labels, and streaming platforms alike. This article delves into the intricate world of streaming revenue. From Spotify to Apple Music, Deezer to YouTube, each platform’s payout structure undergoes scrutiny as artists navigate the complexities of digital distribution.

With insights into minimum and maximum per stream rates across different countries and subscription tiers, based on a real invoice, this article sheds light on the financial realities faced by musicians in the digital age.

The Streaming Royalty Reality

Navigating artist royalties has always been intricate, but the advent of the streaming era has elevated it to a formidable challenge, compounded by the array of rates involved.

Delving into the realm of royalty compensation reveals its intricate nature. Beginners can grasp the basics with a quick Royalties 101 or explore deeper insights in “All You Need to Know About the Music Business” by Donald S. Passman – quite thew insightful read. However, for the context of this discussion, let’s refer to “the team” as we’re unsure of the multitude of specificity of Mariah Carey’s royalties.

It’s a remarkable coincidence that we stumbled upon this book, unaware that it was the very same book (albeit a previous edition) that Ben Margulies utilized to draft that fateful contract for Mariah to sign back in the day. Adding to the twist of fate, Donald S. Passman, the author of the book, eventually became Mariah’s lawyer many years later, as per her Memoir.

This collective encompasses not only performing artists (including featured artists) and songwriters but also the label, publishing company, producers, and an extensive list of stakeholders. However, our primary focus lies in dissecting the payment dynamics of each company, rather than dissecting individual shares.

Mariah Carey herself has publicly acknowledged the paltry sums that artists of her stature, who serve as both performers and songwriters, receive from streaming royalties. She states she receives 1/16th of a penny per stream.

Nevertheless, streaming platforms dominate the landscape of music consumption today. Public disclosures from major platforms reveal payments to labels in the billions, a far cry from the simplified 10% that artists used to earn, on average, per CD sale. Times have evolved, and albeit penny by penny, streaming has emerged as the primary source of revenue for artists (excluding sponsorship deals and tours).

Hence, given our current ownership of a modest portion of certain masters and publishing rights, we’ve opted to unveil the breakdown of payments from various sources. Our chosen example is the song “Felicia Lu – Bitch,” and we’ll utilize this invoice to illustrate actual earnings.

DIGITAL DOWNLOADS

Digital downloads operate similarly to CD sales, offering a relatively straightforward transaction process. You make the purchase, and the label receives payment (along with everyone else involved).

In our dataset, we’ve gathered data on Amazon and iTunes downloads, both priced at 0.99 USD, yielding the same figure: 0.6035 USD. With a 10% deduction and the remainder divided among the performers, each participant receives a solid 6 cents. Given Mariah’s roles as songwriter, performer, and producer across many of her tracks, her percentage is likely elevated.

STREAMING PLATFORMS

This is where things start to get complicated. While we’ll provide the comprehensive report for those curious, let’s begin by highlighting two key factors that impact these royalties:

a) Country of Origin – Each country has its own set of payout rates. With English-speaking countries like Ireland, the UK, the US, and Canada generally offering the highest rates per stream on most platforms, along with smaller European countries such as Austria and Switzerland. On the other end of the spectrum, countries like Belarus and Turkey appear to have the lowest rates we’ve come across so far. However, many countries fall within a similar range, as you’ll see in the detailed report below.

b) Tier – Most platforms feature various tiers, each offering different payout rates: Ad-supported, Trial (promo), Student, Family Plan, and Premium.

Given the significant variation in payouts, values will be presented as ranges or averages, and in US dollars. So, let’s dive in:

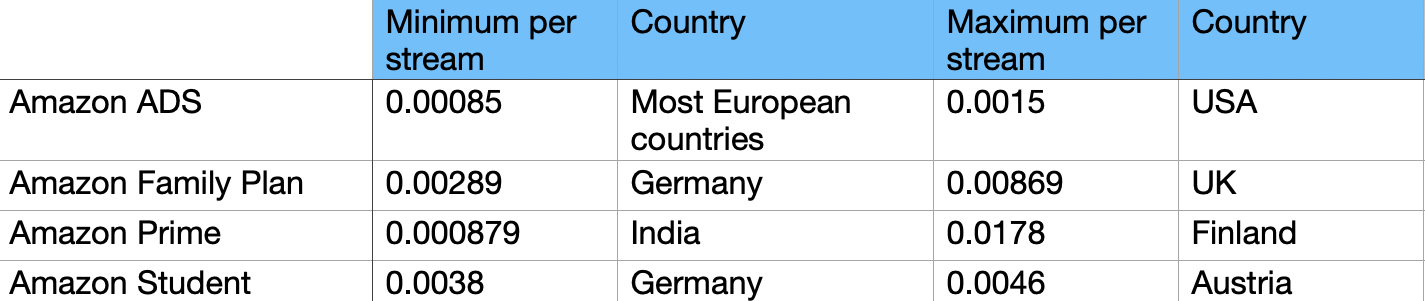

AMAZON

The table outlines the minimum and maximum payouts per stream across different tiers of Amazon’s streaming services and their respective countries. For Amazon ADS, the minimum per stream is approximately 0.00085 in most European countries, while the maximum reaches 0.0015 in the USA. Moving to the Amazon Family Plan, Germany experiences a minimum of 0.00289 per stream, whereas the UK reaches a maximum of 0.00869.

The data highlights significant disparities in payouts across regions, influenced by subscription tiers and local market dynamics. Similarly, Amazon Prime‘s minimum per stream in India is 0.000879, contrasting sharply with Finland’s 0.0178 maximum per stream, showcasing substantial variation. Amazon Student also displays variability, with Germany at a minimum of 0.0038 and Austria at a maximum of 0.0046 per stream.

The potential earnings from Amazon per million streams span from $850 to $17,800. This vast range vividly demonstrates the significant impact of both location and subscription tier on income generation.

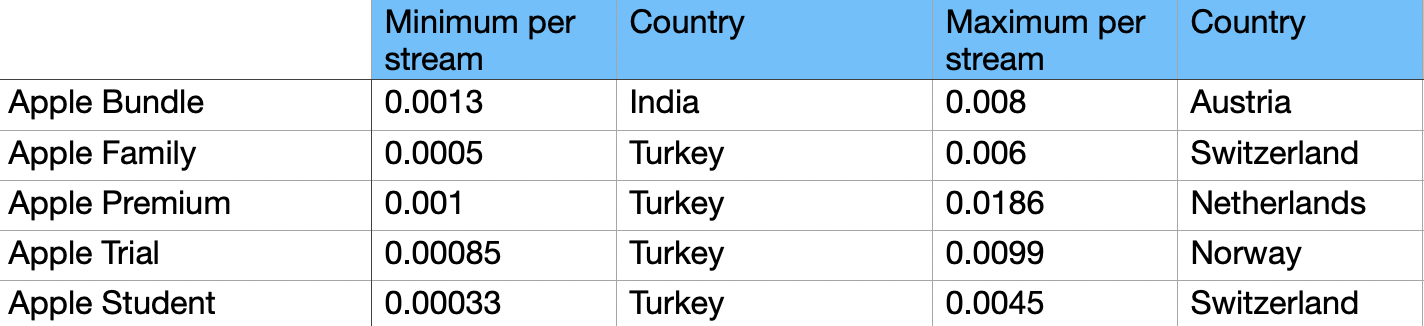

APPLE MUSIC

The table outlines the range of per-stream payment rates across various subscription tiers and countries within Apple Music’s streaming service. It reflects significant diversity in earnings, with rates spanning from 0.00033 to 0.0186 per stream. Turkey consistently appears as the country with the lowest minimum rates across multiple subscription tiers, while Switzerland emerges with the highest maximum rates in the Apple Family and Apple Student categories.

Notably, the Netherlands boasts the highest maximum rate overall, reflecting considerable variance in payment structures across different regions and subscription types within the Apple Music platform. So with Apple platform, we can verify a range income per million streams of 330$-18600$.

AWA

AWA, a Japanese streaming service, operates exclusively in Japan with a flat per-stream rate of $0.00427. With no tiered subscription system, all users hail from Japan, ensuring a focused audience for artists. Earnings from one million streams on AWA total $4270.

DEEZER

The table illustrates the per-stream rates for Deezer across different subscription types and regions. Deezer’s ad-supported streams maintain a uniform minimum rate of 0.0008 across all countries, although specific data for the maximum per stream is unavailable. Deezer Bundle streams also show consistency at 0.0008, with maximum rates reaching 0.007, though the sample size for these figures is small. In contrast, Deezer Premium streams range from 0.0002922 in Ukraine to a considerably higher 0.0473 in Austria, indicating significant variability in payment rates based on subscription levels and geographical location.

Repeating the same formula, we can see the range per one million streams between 292$-47300$

Despite initial impressions suggesting Deezer’s dominance in the streaming realm in terms of payouts, it’s essential to reconsider. Only a single stream commanded a value of 0.0473, with the majority significantly lower in value. Furthermore, Deezer boasts a considerably smaller subscription audience compared to other platforms, a factor we will delve into shortly.

PANDORA

Regarding Pandora, our audience was exclusively from the US, yielding a per-stream rate of 0.0041. Consequently, accruing one million streams on Pandora would translate to earnings of $4100. However, it’s worth noting the platform’s limited audience reach, which remains relatively low.

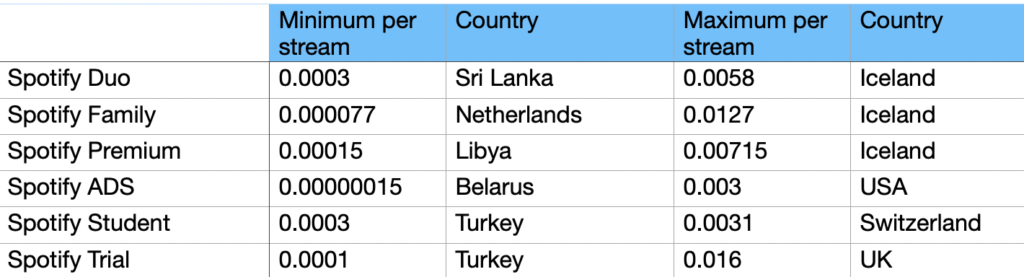

SPOTIFY

The table presents the range of per-stream payouts on Spotify across various subscription plans and countries. From the minimum per stream in Belarus at $0.00000015 to the maximum per stream in Iceland at $0.016, the rates vary significantly. Notably, Spotify Duo offers rates ranging from $0.0003 in Sri Lanka to $0.0058 in Iceland, demonstrating considerable disparity based on geographical location and subscription tier. A million streams on Spotify could yield earnings anywhere from $0.15 in Belarus to a substantial $16,000 in Iceland.

While the initial impression might suggest lower payouts compared to other platforms, it’s crucial to consider Spotify’s extensive user base, which ultimately contributes significantly to overall streaming income.

TIDAL

Tidal’s average payout per stream stands at 0.00715, although this figure is based on a limited representative sample. Extrapolating from this data, one million streams on Tidal would result in earnings of $7,150.

YOUTUBE

The table illustrates the minimum payout per stream for YouTube across different countries. In Germany, the minimum per stream observed was 0.0000001, while in The Netherlands, it is significantly higher at 0.0187. This indicates a substantial disparity in payouts between the two countries.

Therefore, for every million streams on YouTube, content creators would earn anything between $0.1 and $18,700, highlighting the significant difference in payout rates between the two countries.

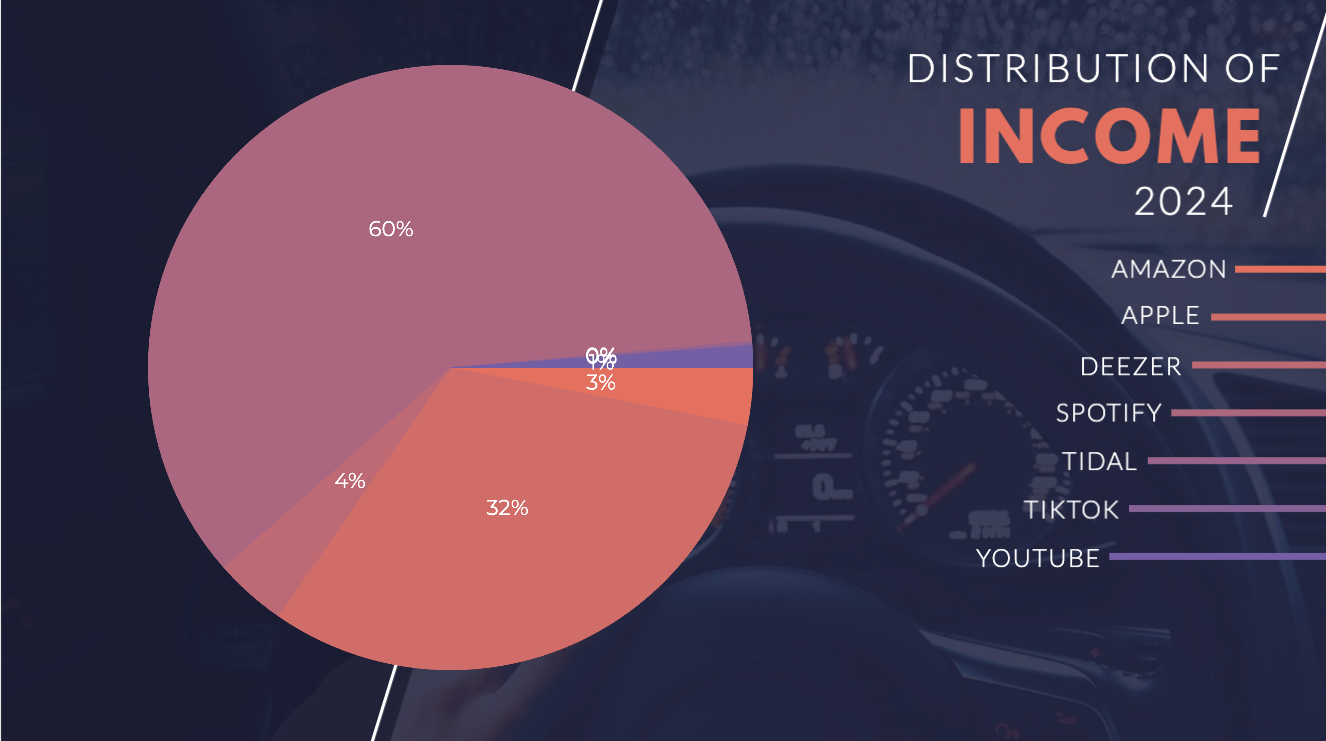

Total Income per Platform

Determining average payouts across streaming platforms is complex due to the wide range of rates influenced by factors like country and tier. However, platforms such as Spotify and Apple, boasting large user bases and generating thousands of streams, offer more reliable data for calculating averages.

To compute these averages, we tally totals and average earnings per platform, taking into account the volume of listens/views each platform receives. This method prioritizes platforms with significant user engagement, ensuring that platforms with minimal activity, despite potentially higher payouts, do not disproportionately affect the overall calculation.

The results reveal a distribution of income across various streaming platforms. While Amazon, Deezer, and Tidal contribute smaller percentages (3.06%, 3.86%, and 0.2%, respectively), Spotify emerges as a dominant player, constituting 60.08% of the total income. This paradoxical situation highlights that, despite its seemingly lower per-stream payout, Spotify’s substantial user base and high engagement result in it being the primary source of revenue in the analyzed context.

Additionally, TikTok, with its unique payment structure not based on views but on number of videos created with specific songs, accounts for 0.044% of the total income. The mention of Universal Music Group (UMG) withdrawing its catalog from TikTok further emphasizes the intricacies of the platform’s compensation model. These findings underscore the importance of considering both payout rates and user engagement when evaluating the overall financial impact of streaming platforms on the music industry.

Based on nearly 50 thousand streams, the average payouts were determined as follows:

– Amazon: $0.011 per stream

– Apple: $0.0146 per stream

– Deezer: $0.008 per stream

– Spotify: $0.0028 per stream

– Tidal: $0.0057 per stream

– TikTok: $0.0057 per video created

– YouTube: $0.0025 per stream

Our findings indicate that the actual average payouts often fall below the figures frequently publicized by these platforms in their announcements.

Streaming Mariah Carey

Consider Mariah Carey’s hit track “All I’ve Ever Wanted” as an example, involving two songwriters and producers (Mariah Carey and Walter Afanasieff), with Mariah Carey as the sole performer. The song is under the Columbia label with publishing by Universal Music Group.

Crunching the numbers, the 4,684,832 Spotify streams for this song would yield an average of $13,117 to date. However, after dividing shares among contributors and accounting for songwriting and production credits, the actual earnings become significantly smaller than commonly perceived.

On the other hand, if we examine the figures for “All I Want for Christmas is You,” the total payout to date stands at $5,040,000 from Spotify alone, presenting ample earnings for all involved parties (per our standards, of course).

If we use the speculative superstar rate of 15% royalty rate, that would leave Mariah little more than half a million to date on the song alone – still a far cry from the advertised 60 million + she has received in royalties from the song alone. This shows that alternative sources of income for the song have a larger role than streaming itself.

Looking at Mariah’s entire catalog on Spotify, it has accumulated $24.5 million by this average per stream rate. Nevertheless, these earnings are dispersed among various stakeholders.

This prompts reflection on whether the era of new artists becoming multimillionaires solely from music creation has passed. By 2024 rates, we can sense it may be quite difficult.

Let us know your opinion below.

Mariah Carey 2025: The Year Mimi Made the Past, Present, and Future Collide